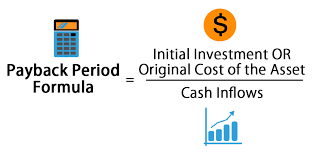

Payback period formula

Discounted Payback Period. To figure out payback period without the solar panel cost calculator we first calculate the true cost of installing solar after incentives have been claimed.

What Is Payback Period Formula Calculation Example

The denominator of the calculation is based on the average cash flows from the project over several years - but if the forecasted cash flows are.

. This has been a guide to Payback Period Advantages and Disadvantages. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. The payback period formula is pretty simple assuming the income generated from the project is constant.

Last years beginning accounts payable balance was 200000 and the ending balance was 205000. After finding this factor see the rate of return written at the top of the column in which factor 5650 is written. For last six month INR 92923 88950 Cr INR 3973 Cr.

Interest Expense Again Loan taken by Tata Motors Ltd. You can learn more about financial analysis from the following articles Dollar-Cost Averaging. Payback Period Initial Investment Net Cash Flow per period If the cash flows are uneven you have.

Accounting rate of return. The payback period is the length of time required to recover the cost of an investment. CAC MRR and ACS or MRR GM of Recurring Revenue Since I am using MRR the formula will calculate the number of months required to pay back the upfront customer acquisition costs.

Interest Expense is calculated using the formula given below. Thus its use is more at the tactical level than at the strategic level. If a 100 investment has an annual payback of 20 and.

In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365. So the average payment period the company has been operating on is 84 days. Initial Investment describes your original expenditure in.

Payback Period Years Before Break-Even Unrecovered Amount Cash Flow in Recovery Year Here the Years Before Break-Even refers to the number of full years until the break-even point is met. Which when applied in our example E9 E12 32273. Advantages and Disadvantages of Payback Period formula.

Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset. Loan INR 3973 Cr. A project costs 2Mn and yields a profit of 30000 after depreciation of 10 straight line but before tax of.

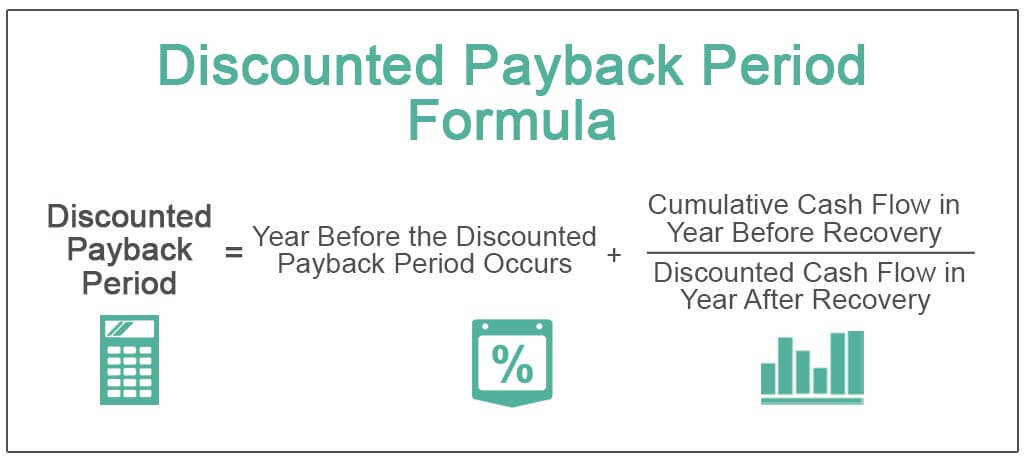

If the cash flows are even you have the formula. Discounted Payback Period - ln1 - investment amount discount rate. The longer the payback period of a project the higher the risk.

Payback Period Example. The Final Step as now we have calculated both negative cash flow years years to reach break-even point and fraction value exact yearsmonths of payback period To calculate the Actual and Final Payback Period we. Jan 3 2023 - Mar 15 2023.

The total for credit purchases over the year was 875000. It is usually calculated for only one period. Cash flow per year ln1 discount rate The following is an example of determining discounted payback period using the same example as used for determining payback period.

Since the useful life of the machine is 10 years the factor would be found in 10-period line or row. The payback period formula does not account for the output of the entire system only a specific operation. For Example XYZ Inc.

Say Kapoor Enterprises is considering investments A and B each requiring an investment of Rs 20 Lakhs today and cash flows at the end of each of the following 5 years. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period. The payback period of a given investment or project is an important determinant of whether.

Terms used in payback period formula PMP. Negative Cash Flow Years Fraction Value. The rate of Interest per annum 525.

The formula is given below. This formula can be applied towards any kind of project irrespective of time duration capital size etc. The formula for discounted payback period is.

Average Collection Period Formula Average accounts receivable balance Average credit sales per day The first formula is mostly used for the calculation by investors and other professionals. Then we compare that against the cost of electricity from the utility company which tells us how long it takes to break even on the system. When deciding whether to invest in a project or when comparing projects having different.

In other words it is the number of years the project remains unprofitable. To calculate the payback period you need. Intramural New Renewal Awards.

Sep 1 2022 - Nov 17 2022. Use the PMP exam formula below to calculate the payback period of a project. The payback period does not factor in churn or.

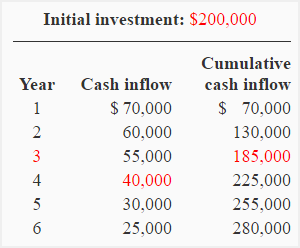

The payback technique states how long it takes for the project to generate sufficient cash flow to cover the projects initial cost. The payback period determines the period in which the cumulative cash flows of a project turn positive for the first time. Lets understand the Payback Period Formula and its application with the help of the following example.

As mentioned before it is the most straightforward way to calculate the time taken to reach the break-even point. Is considering buying a machine costing 100000. Use the formula below.

Sep 1 2022 - Nov 17 2022. Intramural ACGME New Awards. The basic formula of the ROI is a division of expected constant returns by the investment amount.

Formula of Discounted Payback Period. A discounted payback period gives the number of years it. Interest Expense Principal Amount Total Borrowed Amount Rate of Interest Time Period.

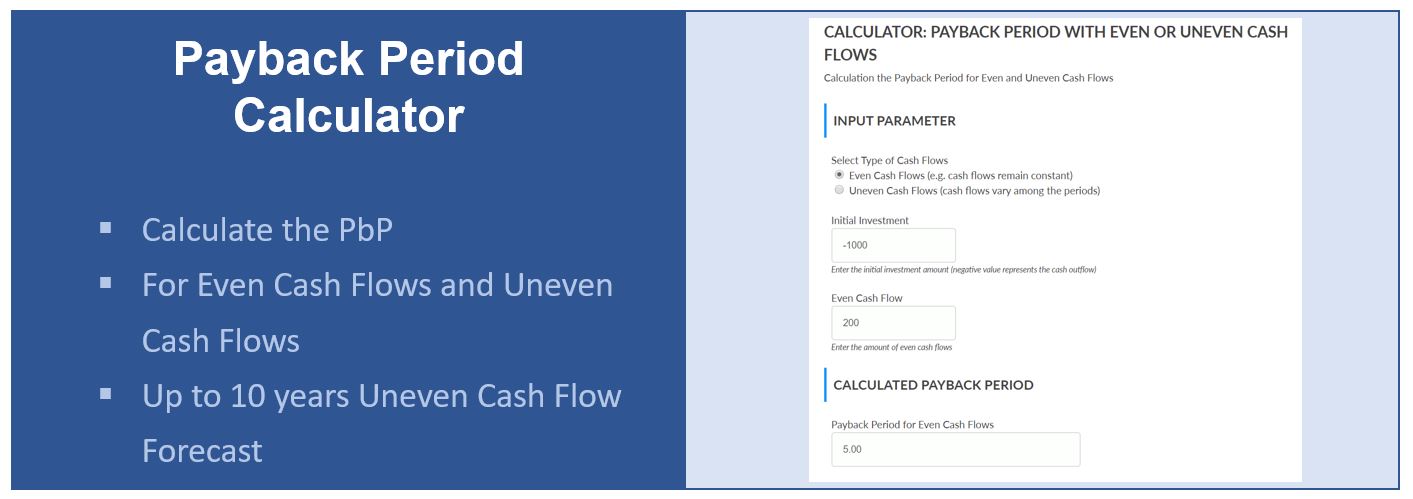

Jan 3 2023 - Mar 15 2023. The formula to figure this is 200000 205000 2 so the average accounts payable is 202500. Payback Period Years before full recovery Unrecovered cost at the start of the year Cash flow during the year The ClearTax Payback Period Calculator calculates the payback period depending.

At that point the initial investment has been paid back. Payback Period 3 1119 3 058 36 years. One of the simplest investment appraisal techniques is the payback period.

Here we discuss the top advantages disadvantages of the payback period along with examples and explanations. Step 2 Calculate the CAC Payback Period. Payback period Formula Total initial capital investment Expected annual after-tax cash inflow.

Calculate The Payback Period With This Formula

Discounted Payback Period Meaning Formula How To Calculate

Payback Period Method Double Entry Bookkeeping

What Is Payback Period Formula Calculation Example

Discounted Payback Period Formula And Calculator Excel Template

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

Payback Period Formula And Calculator Excel Template

Payback Period Summary And Forum 12manage

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

How To Calculate The Payback Period With Excel

Payback Period Method Commercestudyguide

Undiscounted Payback Period Discounted Payback Period

How To Calculate The Payback Period With Excel

How To Calculate The Payback Period With Excel